WTI upside seems cushioned amid recession concerns

As widespread lockdowns in China and weak Chinese economic data fueled fears of a global recession, oil prices fell on Monday. However, the market found some support with the European Union moving closer to banning imports of Russian crude.

The broad outlook for oil prices is bullish due to the EU planned embargo on Russian oil and slow increases in OPEC production.

Technical view

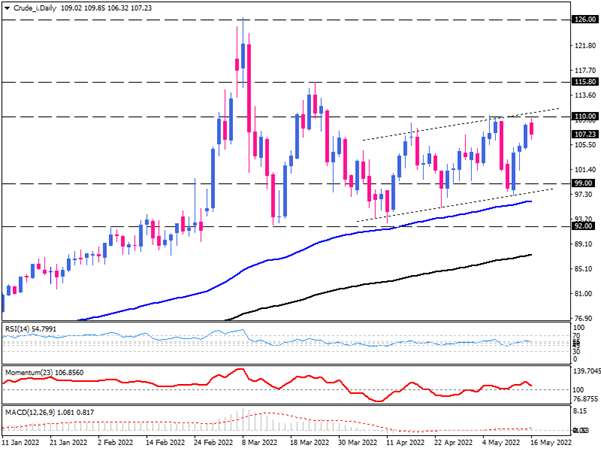

From a technical perspective, WTI is trading in an uptrend above both the 100 and 200-day exponential moving averages. After some sharp fluctuations in recent weeks, price action has pictured a slightly ascending channel, and prices are trading near its upper line. Price may soar toward the dynamic support line near $99 per barrel if the channel's resistance holds. Nevertheless, the uptrend will remain intact as long as the price stays above the rising moving average. Buyers will keep an eye out for the 115.80 and 126.0 zones as potential resistance levels.

Short term momentum oscillators show a lack of directional indications, with the RSI hovering in the neutral zone between 60 and 45 in the last two months. Momentum is pointing down from the buying region. This suggests that retreating buyers may have run out of steam after facing resistance around $110.

MACD bars also represent turbulent conditions with several peaks and valleys below and above the zero-line for a while.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.