USD/CAD: Double Trouble for the Greenback Against the Loonie

The USD/CAD, a currency pair often influenced by oil dynamics and North American economic health, has given traders quite a storyline in the one-hour timeframe.

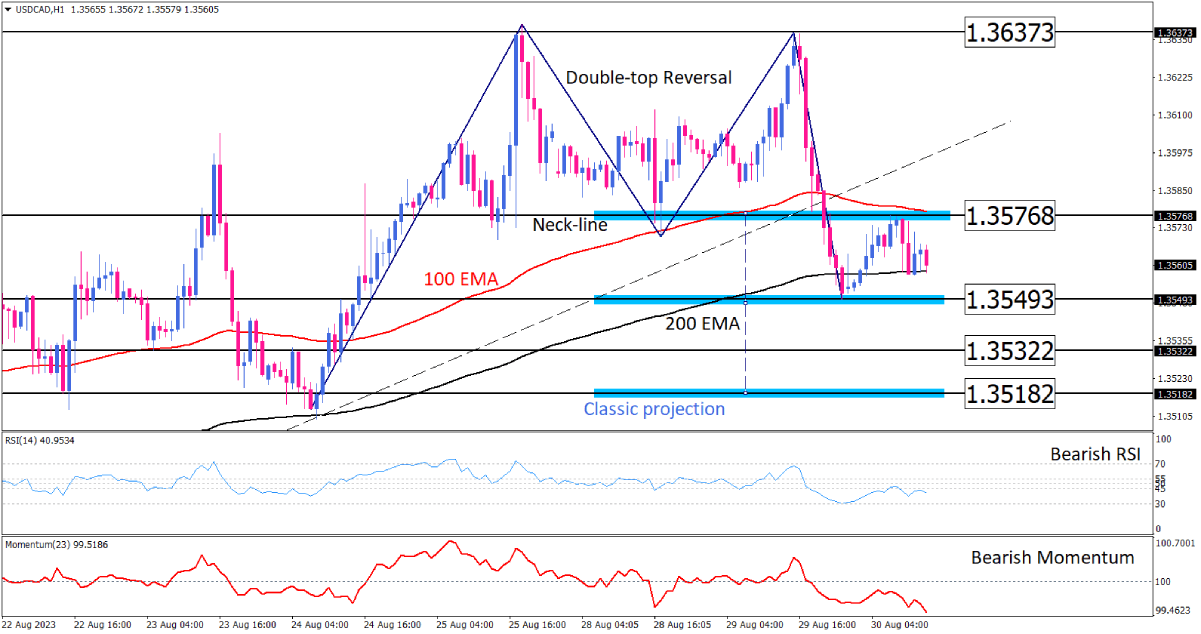

The pair showcased a bullish run since the end of July, but recent developments hint at a turning tide. A conspicuous double-top bearish reversal pattern has emerged, a formation that often indicates a potential trend reversal. The completion of this pattern was evidenced by a decisive break of its neckline around 1.35768.

Further accentuating the bearish narrative, this break also resulted in a breach of a one-month uptrend line. Additionally, the pair succumbed to the pressure exerted by its 100 EMA (Exponential Moving Average), signaling a strengthened bearish grip.

Recent Price Action & Levels to Watch

Post the pullback to the previously broken neckline, sellers have firmly taken the reins, driving the pair to 1.35493. If this bearish momentum persists:

- The immediate downside target stands at 1.35322.

- Following that, 1.35182 emerges as the next critical level. Notably, this is the classic projection of the double-top reversal pattern.

Oscillators Weigh In

The Relative Strength Index (RSI) is currently on a downward trajectory within the selling zone. This movement insinuates that sellers are consolidating their position. Amplifying this sentiment is the Momentum indicator, which is plummeting at an accelerated pace, echoing the mounting selling pressure.

A Glimmer of Hope – The Alternate Scenario

For those rooting for the greenback, all eyes will be on the 200 EMA during Wednesday's trading session. This moving average could serve as the last bastion of defense for buyers. However, even if this level holds, a convincing shift in sentiment would require a break above the crucial 1.35768 mark.

Conclusion

The technical tableau for the USD/CAD in the one-hour timeframe currently leans bearish, underpinned by pattern formations and oscillator readings. As always, traders are advised to combine this technical perspective with macroeconomic events and exercise prudent risk management.

Disclaimer: The above analysis is purely for informational purposes and should not be construed as investment advice. Always consult with a financial advisor before making any trading decisions.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.