USD/CAD rally stalls near key resistance

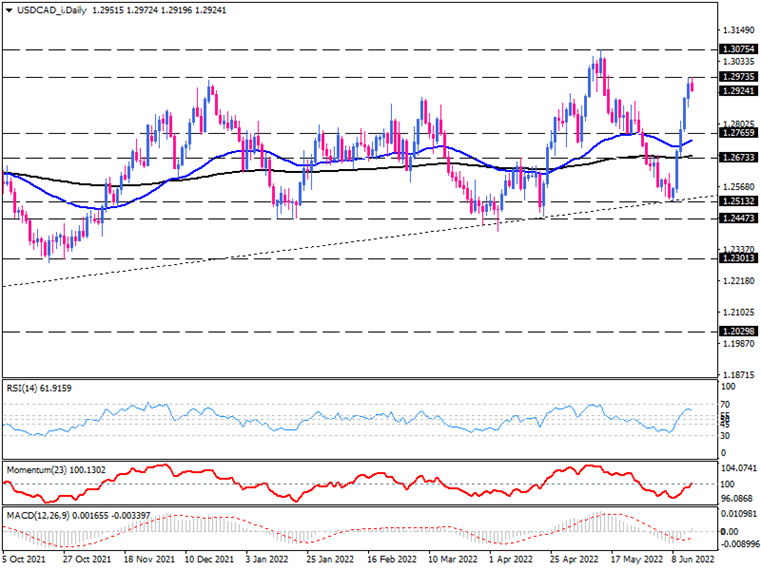

On the daily chart, the USD/CAD rally has found relief after gaining for four days in a row, with buyers taking a breather around one-month record highs at 1.29735 ahead of the US retail sales data and Fed's policy announcement. We can also see emerging correction waves in other major pairs, as markets are stabilizing after sharp fluctuations in recent days. The broad picture shows the pair has been stuck in a wide ascending triangle pattern since last August, and sellers have another chance to flex as USD/CAD hangs out near the upper edge of the pattern. If this pattern's resistance holds dollar may dip back towards the 1.27659 hurdle against the Loonie, which is in line with the 50-day exponential moving average. Suppose bearish momentum intensifies, the further decline could push the price down towards the 200-day EMA around the 1.26733 mark.

However, if US data comes stronger than expected or the Federal Reserve proves to be more hawkish by increasing rates higher than 50 basis points, buyers will get back to their seats to tackle the 1.29735 barrier. If that is the case, USD/CAD would appreciate and make its way back up to May's top at 1.30756, which is the record high in seven months.

Short-term momentum oscillators draw a mixed picture today. RSI is hanging out in the buying region. Momentum is flirting with the 100-threshold after pulling up in the selling area, which means selling forces do not feel overly strong. Meanwhile, MACD has posted its first positive bar above the zero-line, keeping hopes for bulls to return.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.