S&P500 rally is out of steam ahead of NFP

S&P500 on the four-hour chart is trading muted on Friday, ahead of the widely expected US non-farm payrolls report, which is due later in the session.

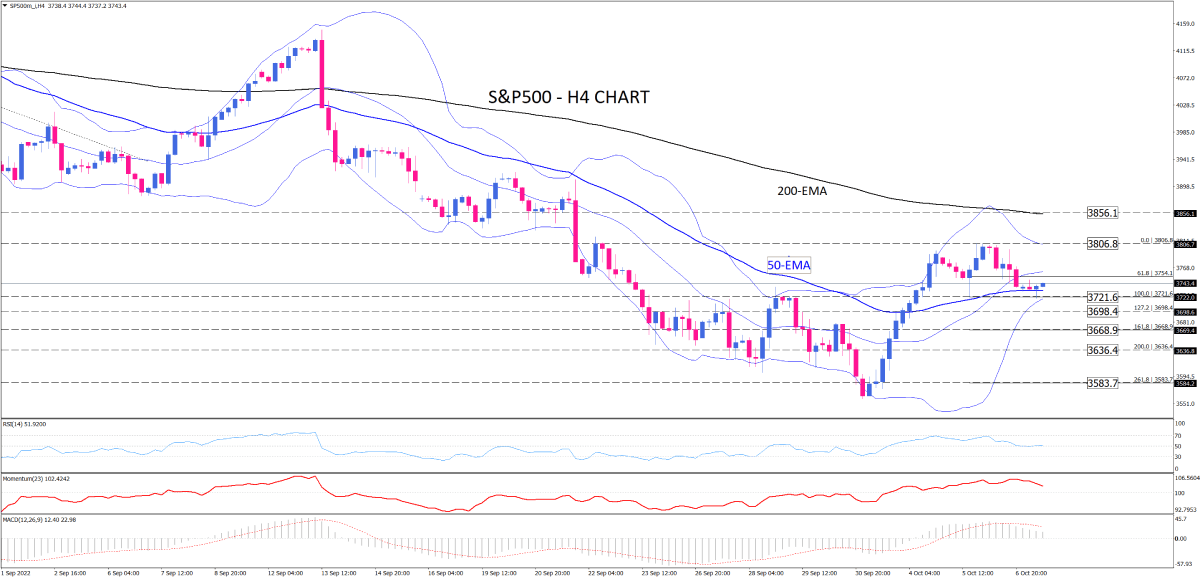

After falling into the lower half of the Bollinger bands, the index is hanging on the 50-EMA support level, which is in confluence with the last bottom at 3721.6. The recent rally has proved to be short-lived as the bullish bias is losing steam with the price retreating from the 3806.8 resistance region. Though, the next direction of the price depends on the 3721.6 crucial level.

Should this level hold, buyers will bounce back toward the 3806.8 mark from the 50-EMA support area. A sustained break of this barrier will pave the way to resuming the rally towards the 200-EMA around the 3856.1 mark.

Otherwise, since Bollinger bands exhibit a fading bullish bias, and the bands have been narrowing regarding price consolidation, an emerging M pattern may rule out the market. Thursday’s top, which is totally within the bands is considered a relatively lower top compared to Tuesday’s top, which closed out of the bands. Hence, 3721.6 is the M-pattern neckline, and penetration of this level will confirm the pattern, accelerating bearish sentiment. If that happens, the immediate target for sellers can be estimated at around 3698.4. A sustained move below this hurdle can take the pair down to 3668.9, 161.8% of the last upswing. Further declines will put 3636.4 and 3583.7 in the spotlight.

Short-term momentum oscillators imply that bullish sentiment is fading. RSI has dropped to 50 from the overbought level. Momentum, which has seemingly peaked around one-month highs in buying region, is pointing down. Positive MACD bars are shrinking below the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.