S&P500 bears face a key support to retain the fall

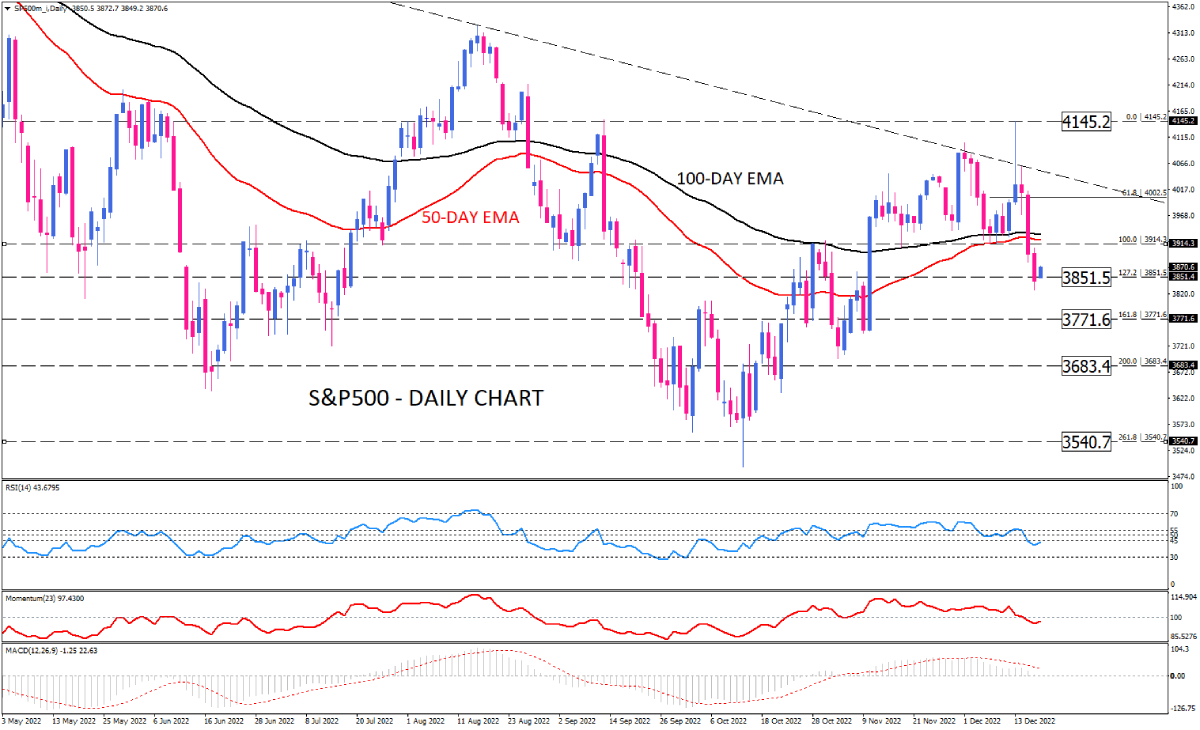

The S&P500 futures index is likely to recover some losses on Monday after falling sharply for three days in a row as 3851.5 is proving to be a barrier for sellers to overcome. In a larger picture, however, this major average has been in a downward trend since January and is on track to post its worst year since 2008.

According to the daily chart, intensifying bearish sentiment has caused the market to penetrate both the 100-Day and 50-Day exponential moving averages by breaking 3914.3. As looming recession fears continue to weigh on stocks, this barrier may not hold, with sellers aiming for the lower support at 3771.6, located at the Fibonacci 161.8% projection from the last upswing between December 8 and December 13. In the event that sellers become able to move below this hurdle, the 3683.4 will be waiting to face the decline.

Alternatively, if buyers were to regain control again, the 3914.3 mark would be claimed by them, which would be in line with the influence of the moving averages.

Momentum oscillators show a bearish bias over the short term. The RSI is moving into a selling zone. Momentum is hovering below the 100 mark, and MACD bars are about to cross zero into the negative zone.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.