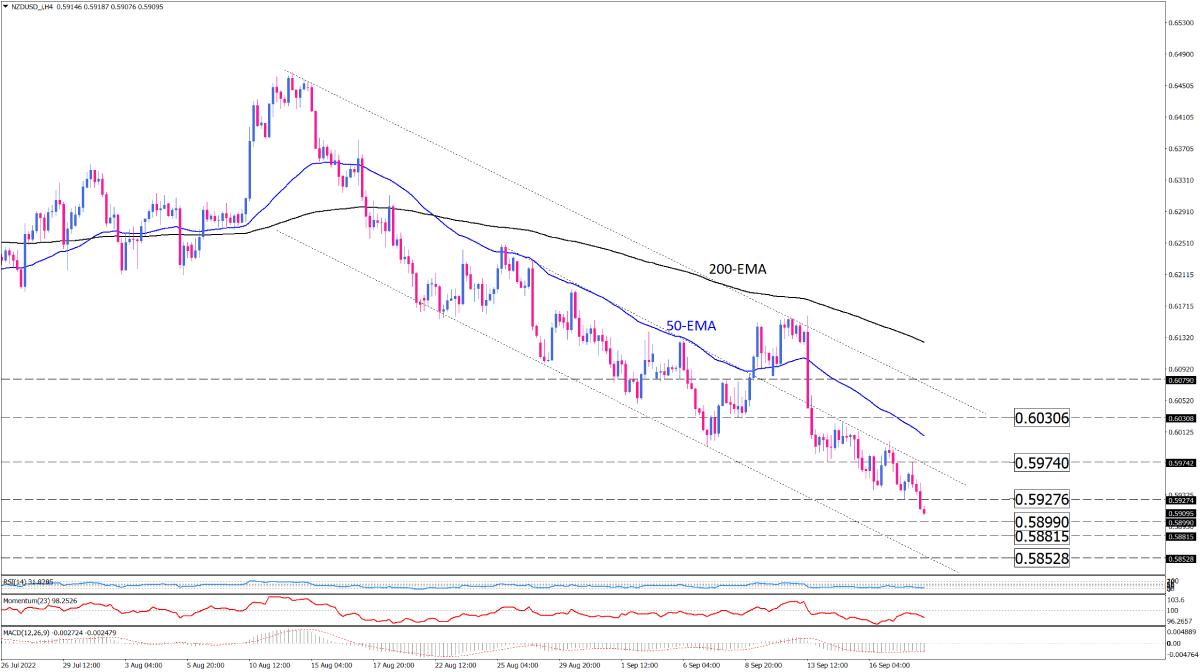

NZD/USD sellers aim for lower supports

Since mid-August, NZD/USD has been trading in a downtrend, within a descending channel, below the 50 and 200 exponential moving averages on the four-hour chart. After some consolidation, sellers finally gained enough momentum to break the 0.59276 barrier on Tuesday morning, resuming the downtrend toward the channel’s lower line. However, there are some obstacles sellers need to overcome before getting there. Persisting selling pressure can bring the price down to 0.58990. Clearing this barrier will pave the way toward 0.58815. If sellers manage to push the pair below this hurdle, 0.58528, lining up with the channel’s lower line, can prove to be the next support level.

Alternatively, should buyers show up during the journey, 0.59740, around the last market top, will be waiting for them on the way up. If that level fails to stall the rally, buyers will target the 50-EMA.

Short-term momentum oscillators imply a sustained bearish bias. RSI points down in the selling region, close to the 30-level. Momentum is also moving down below the 100-threshold. MACD bars are edging down in the negative territory, trying to cross the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.