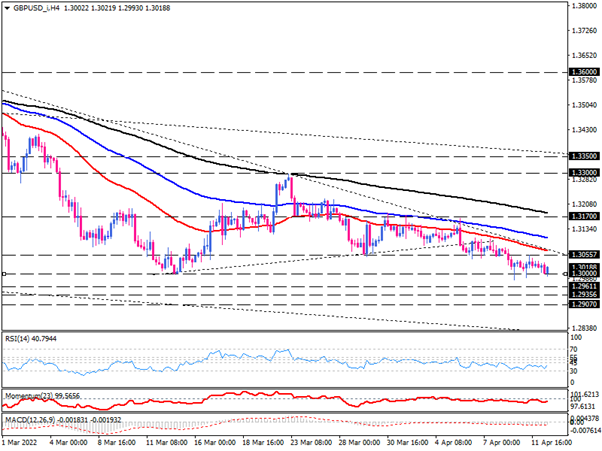

GBP/USD sellers take a breather at the 1.30 key level

Sterling looks bearish on the four-hour chart since it is trading below the 50, 100 and 200 EMAs, breaking primary support levels to the downside. After some rangebound trading between 1.30557 and 1.3170, the stronger dollar dragged the pair lower, with sellers aiming to reach a psychological barrier of 1.300.

Should they pass this hurdle, the pound can fall to the following support at 1.296111. This level should be able to limit the negative Momentum for a moment. However, if it fails, 1.29356 may provide subsequent support. In case selling pressure intensifies by breaking this hurdle, the further loss will result in falling towards 1.29070 in the event of a further decline.

On the other hand, if the 1.30 psychological level defeats the selling forces, the GBP/USD is likely to make gains towards the previous high at 1.30557, which is in line with the confluence of the descending trendline and the falling 50-period exponential moving average.

The short-term outlook can entirely shift bullish if we see a decisive break of this resistance zone, and we can turn our attention back on the 1.3170 previous level of interest.

Despite the short-term momentum oscillators' support for the overall bearish bias, they also imply that the selling pressure is slowing. The Relative Strength Index has stayed in the selling range for some time now. Currently, Momentum sits below the 100-threshold. Additionally, the MACD lines with negative values are slightly nudging in the direction of a flattening signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.