GBP/USD forms a short-term bearish reversal pattern

GBP/USD is falling towards 1.19221 as political uncertainty in the UK offsets aggressive BOE, tightening expectations ahead of the ECB's crucial decision, while the US dollar recovers losses amid a shift in risk sentiment.

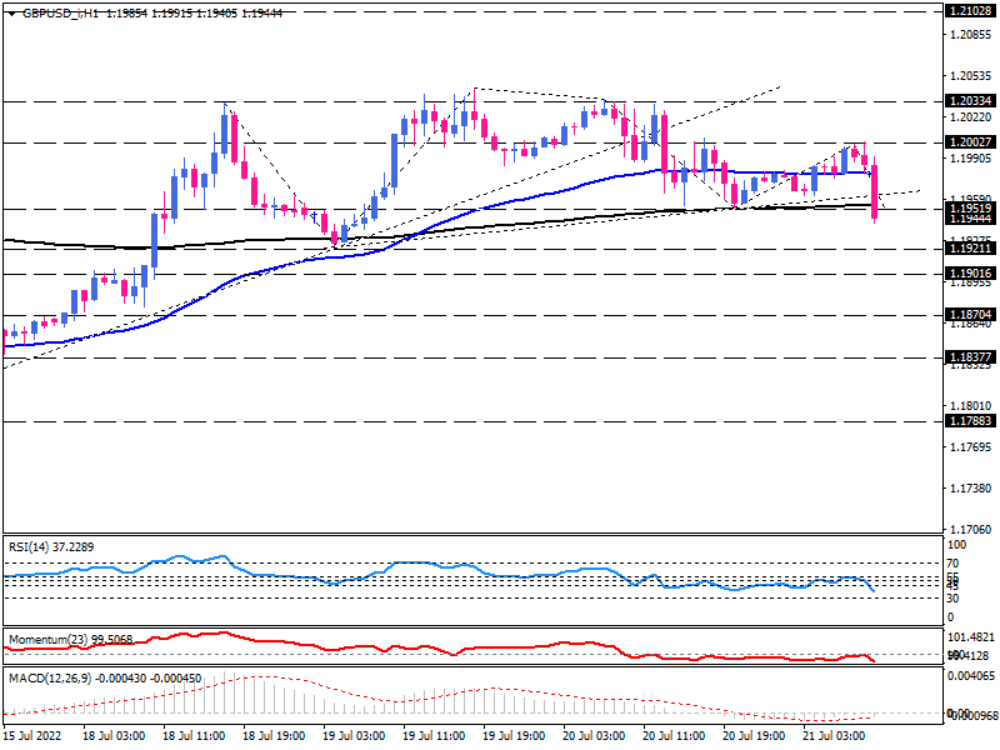

GBP/USD bears unleashed their power to form a bearish reversal on the one-hour chart. After riding an uptrend for one week, buyers finally gave up around 1.20334, prompting a reversal. Thursday's European trading session witnessed a sharp drop in prices resulting in losing the 1.19519 support level, surrounded by yesterday's bottom and 200-hour exponential moving average. A break of this crucial barrier confirms a head and shoulders pattern, which may get more sellers on board. If bearish sentiment persists, the immediate obstacle to halting the fall is expected at 1.19211. A decisive breach of this support will put 1.19016 on the sellers' radar. Further depreciation of the pound can lead to breaking this obstacle. If so, the weekly bottom at 1.18704 will be waiting for the sell-off.

Otherwise, should buyers find the price interesting enough to step into the market, the GBP/USD can get on the front foot to recapture the 200-hour EMA. A sustained move above this moving average can keep the pair sideways between 1.19519 and 1.20027.

Short-term momentum oscillators support the sell-off. RSI is falling in the selling area towards the 30-level, and momentum points below the 100-threshold. Likewise, MACD bars decrease in the negative region, crossing below the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.