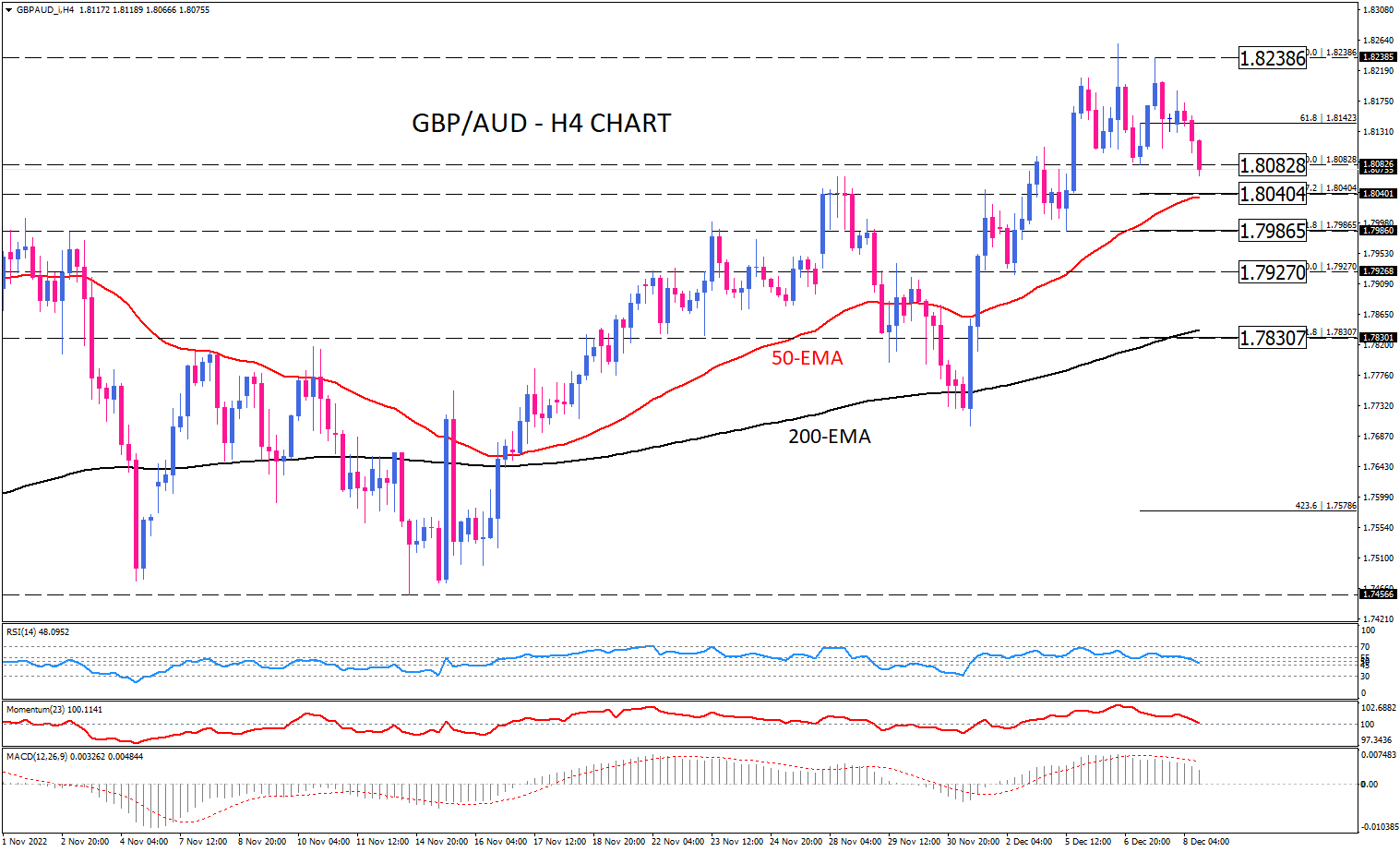

GBP/AUD bears struggling with a key support

GBP/AUD sellers are attempting to reverse the three-week rally by dragging the price below the intraday support of 1.80828 on the four-hour chart. Violating this last bottom has resulted in turning attention towards the 50-exponential moving average, which is located around the 1.80404 hurdle.

Although a probable bearish reversal is about to occur, the broad outlook is still considered bullish as the market is above its long and short Moving averages. More conservative sellers may wait to evident a clear penetration of the 1.80404 barrier to join the market. If that happens, intensifying bearish momentum can send the pair towards the low of December 5 at 1.79270. a breach of this barrier will prompt further losses for the pound towards the 200-EMA, around 1.78307.

Alternatively, should sellers catch a moment to hold the 50-EMA intact, the pair may remain sideways, looking up to pare some losses, rising towards the immediate resistance at 1.81423. even if that’s the case, they still need to overcome the YTD top of 1.82386 to resume the uptrend.

Short-term momentum oscillators suggest buyers have been retreating from the peak but sellers have yet to prove their control. RSI is moving downward but in the neutral zone, implying a lack of sufficient directional forces in the current market. Momentum is also decreasing towards its baseline, indicating the absence of bullish bias. At the same time, MACD bars are shrinking in the positive territory and the signal line has got a negative slope due to fading buying forces.

In conclusion, buying bias is waning but sellers need more strength to get back in full charge and establish a new trend.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.