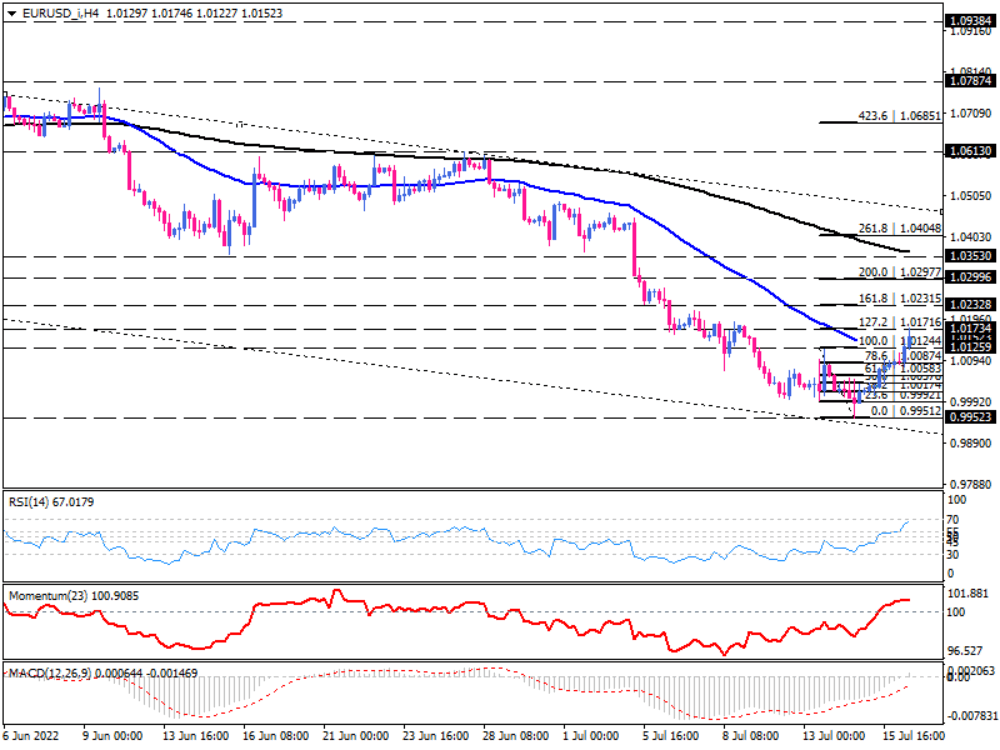

EUR/USD extends short term rebound above a crucial resistance

On the four-hour chart, EUR/USD has been trading within a downward channel since early February. As softening economic growth, rising prices and the energy crisis bear down on the Eurozone outlook, the Euro fell to parity against the dollar for the first time in 20 years.

Nonetheless, the pair has bottomed around a twenty-year low at 0.99512 since the dollar edged lower from its multi-decade peak as expectations of a more hawkish Fed walked down on Monday. That led the pair to soar above the 50-EMA and break the last top at 1.01244. Increasing buying forces have sent the price towards the immediate resistance level of the 127.2% Fibonacci projection, which lies at 1.01716. If buying pressure persists, euro buyers may overcome this hurdle and pull up the rally towards the 1.02315 mark, which is in line with the 161.8% Fibonacci level. Overstepping this barrier will put 1.02977 in focus.

Otherwise, if sellers consider this resistance, they would drop the price back down to the 50-EMA around 1.01244.

Bullish momentum is peaking up according to short-term momentum oscillators. The RSI is climbing in the buying zone and attempting to hit 70. Likewise, momentum has bounced off the 100-basis, suggesting an escalating bullish bias in the short term. While MACD bars have crossed above the zero-line, and the move is followed by the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.