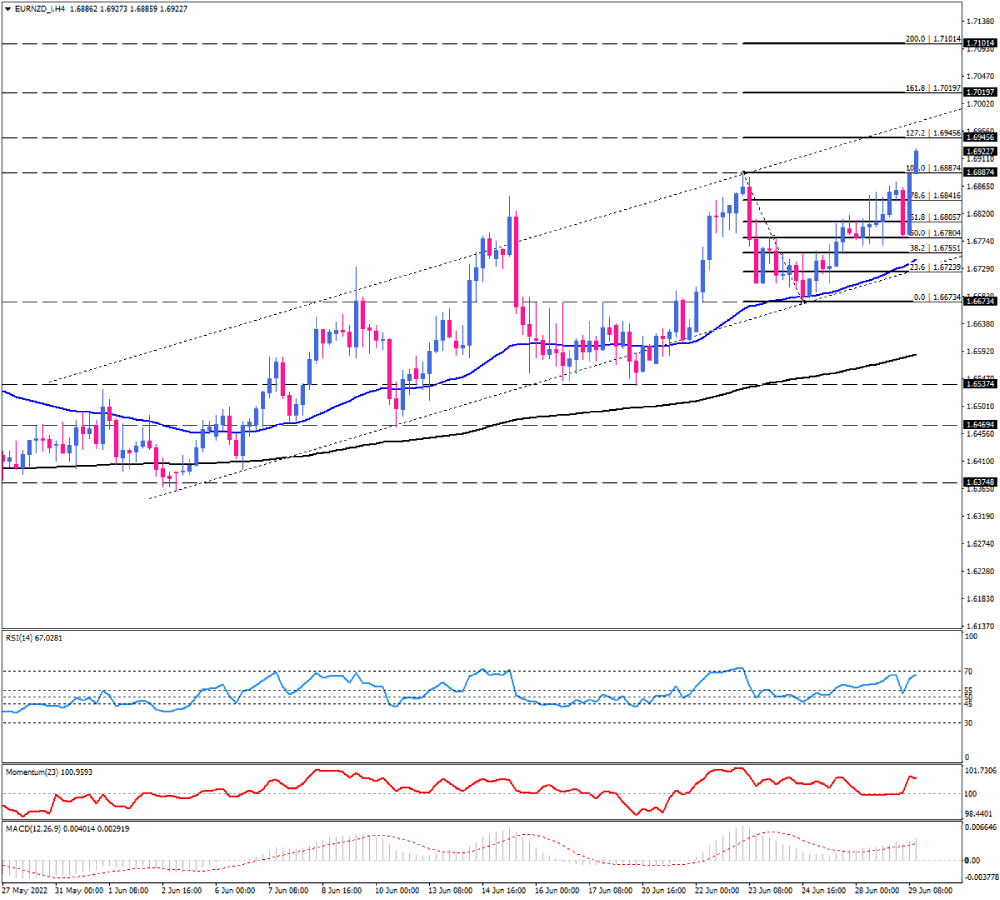

EUR/NZD gains upside traction within an ascending channel

As market sentiment becomes more fearful of a possible recession, risk-sensitive currencies like the New Zealand dollar become more vulnerable. A good example would be EUR/NZD, as the pair is heading upwards within a one-month ascending channel. This upside movement comes after market participants increased their bets on the rate hike by the ECB, which will begin in July. Hence, the euro can be supported to move into higher ground.

On Wednesday, EUR/NZD buyers succeeded in passing over the four-month top at 1.68874 following a pullback from the 50-EMA. A sustained move above this hurdle could lead to the 1.69456 mark, which lines up with the 127.2% Fibonacci extension of the prior downswing. If bullish traction extends above this barrier, it will leave buyers hopeful about reaching the confluence of the channel's upper line and 161.8% Fibonacci level. As such, this area can serve as significant resistance to slowing down the rally for a time.

The downside scenario will come into play if sellers return to the market, driving the price toward the 50-EMA. Even so, as long as the ascending channel holds up, EUR/NZD remains bullish for the foreseeable future.

The momentum oscillators indicate a bullish bias in the short term. RSI is advancing in buying territory, and momentum is also moving above the 100-baseline. Positive MACD bars also rise after crossing above the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.