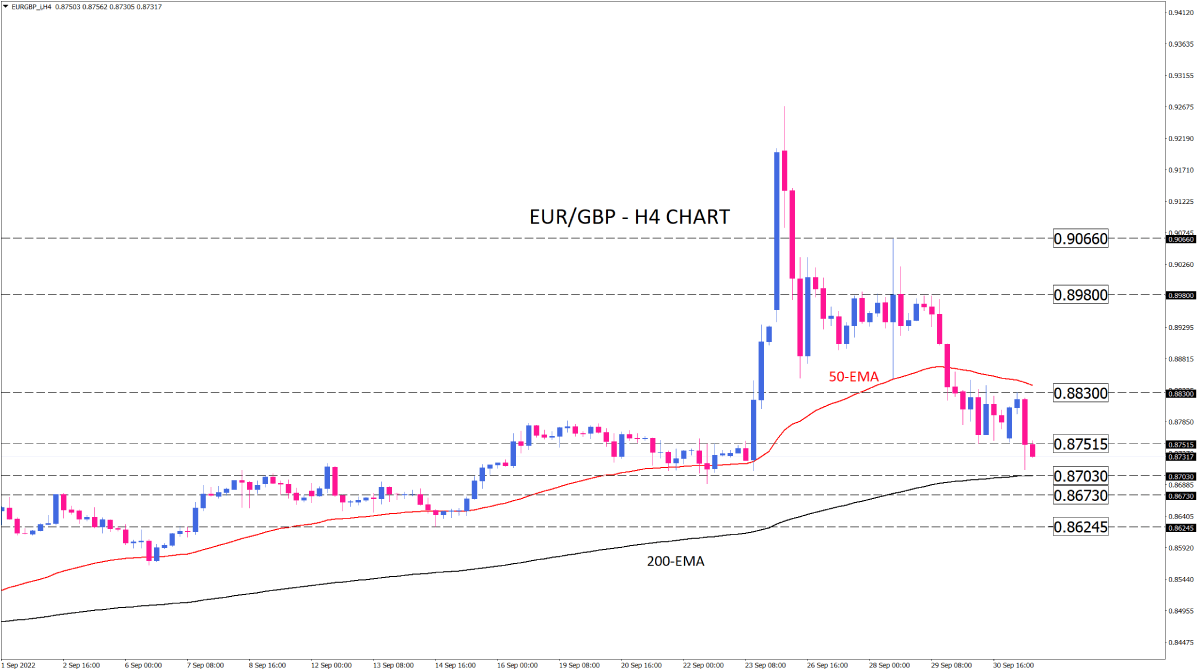

EUR/GBP sellers continue to dominate near-term

EUR/GBP on the four-hour chart is likely to remain on the back foot in the short term due to the strengthening British pound. The bearish move has been extending since sellers retreated from the 0.92684 peak last week.

Prevailing selling pressure had the pair fall below the 0.87515 support line to end Friday’s short-term sideways. Consequently, bears look likely to push prices lower. The immediate support can be estimated at around 0.87030, which is in line with the 200-exponential moving average. In the case of intensifying bearish sentiment, a sustained move below this hurdle can trigger further decline and put the 0.86730 barrier in the spotlight. If this level fails to hold support, more sellers will target the 0.86245 barrier.

Otherwise, should buyers defend the 200-EMA support zone, they may take control of the market, reclaiming the range top around 0.88300, which lines up with the 50-EMA. Even if this action causes some consolidation to the upside, bulls need a clear break above the short-moving average to form a reversal.

Momentum oscillators indicate an accelerating selling sentiment. RSI is pulling down near the 30- level and momentum hovering under the 100-threshold. Likewise, MACD histograms stand on the short side since MACD bars are growing in negative territory below the falling signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.