Crude oil recovers from three-month lows on continued global recovery

Crude prices continued to rise on Tuesday as concerns eased about the global economic recovery amid increasing optimism that the Omicron variant of Covid-19 will not impede the worldwide economy and, in fact, may actually speed up the end of the pandemic.

As a result, crude oil has signalled signs of recovery after experiencing a massive sell-off last week due to the spread of the Omicron variant. However, several positive signals this week indicate a continued economic recovery and a strengthening of global demand, leading to higher oil prices.

Saudi Arabia raised the price of crude oil on Sunday, another sign of increased optimism about oil demand.

Despite US strategic petroleum reserves release, OPEC+ producers have agreed to increase output by 400,000 barrels per day from January 2022 to meet the growing demand.

This week, the focus shifts to the data relating to the US weekly crude stockpiles, released by the American Petroleum Institute (API) later on Tuesday. Still, the leading market driver will remain risk sentiment.

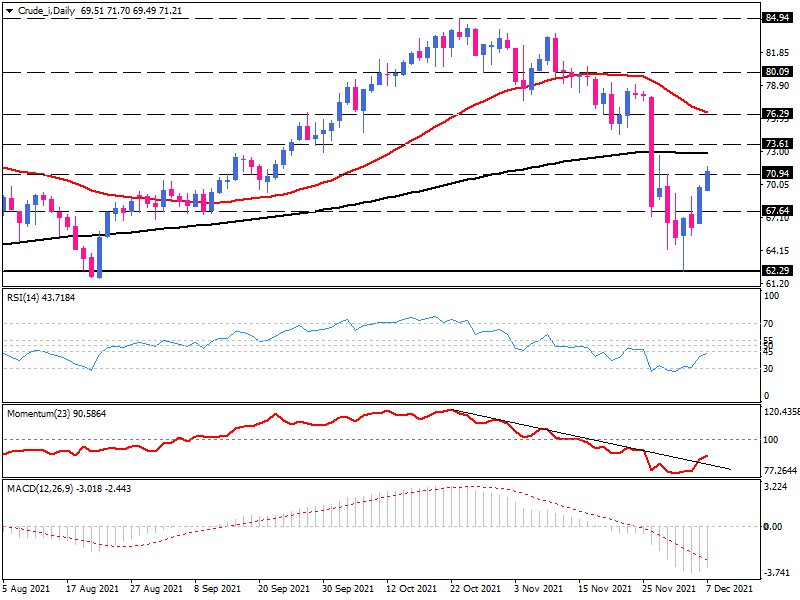

Crude oil on the daily chart

Crude is trading below the 50-day and 200-day exponential moving averages on the daily chart, forming lower highs and lower lows. Despite this, buyers took advantage of the three-month low of 62.30 dollars to limit further losses by posting a reversal hammer candlestick which ended up limiting losses.

An upward price trend is underway, and the 72.85-boundary, sitting near the %50 Fibonacci-retracement and the 200-day exponential moving average, is likely to act as immediate resistance. Should bulls overcome this obstacle, positive momentum would likely lead to the next hurdle at the 76.29-stretch near the 50-day moving average.

Momentum oscillators also appear to support the recovery in some ways. The relative strength index (RSI) is moving upward from oversold territory toward 50, and momentum seems to be heading north following the penetration of its downtrend line. MACD shows a mixed signal with the MACD bar increasing towards its zero-base level but still below its signal line in the negative zone.

Alternatively, if sellers resume control, immediate support would be located around the 67.64 level. Having broken this barrier, the bears may be approaching the crucial support level of the 62.30 low, and sinking further would turn the odds favouring the bears to resume the downward trend.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.