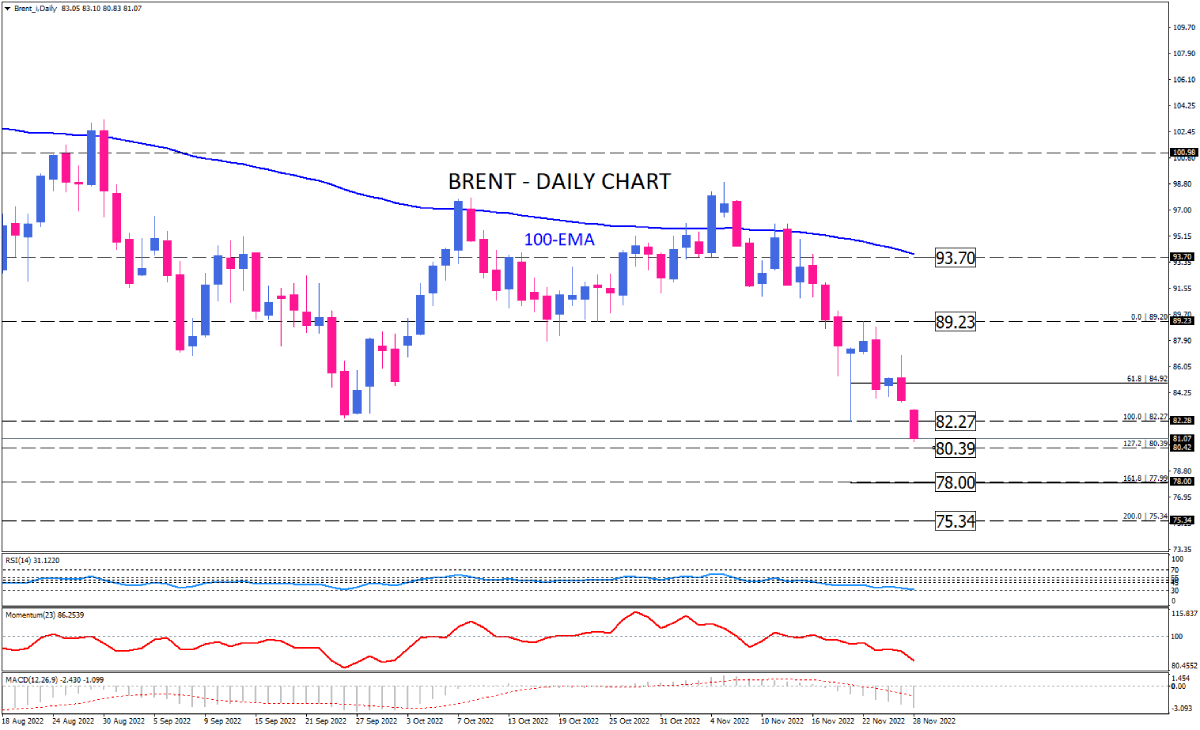

Brent prices sink to lowest level YTD

Brent has been trending down since November 7 after sellers pushed the price below the 100-EMA and extended the fall by breaking the sub-89 key support zone. Along with a three-week decline, bears took the lead again earlier on Monday, passing the previous bottom at 82.27 to get the price to its lowest level since January.

If bearish sentiment continues to prevail, Brent could face an immediate barrier around the psychological level of sub-80. Any further pressure that results in breaching this roadblock would pave the way towards the 78 hurdle. In the event that this support fails to limit losses, 75.34 will be waiting to confront market turmoil.

Alternatively, should the 80-level provide sufficient support for the price, buyers may step in to retest the 82 sub-level. However, as long as the price is trading below its 100-EMA value, the broad picture is considered bearish.

Short-term momentum oscillators reflect a substantial bearish bias. RSI is trending down on the verge of an oversold area, suggesting that selling forces are about 2.5 times greater than buying forces. Momentum is also pointing downward, approaching its extreme levels in the selling area. Likewise, MACD bars have crossed the signal line below zero, dipping further, which is another indication of intensifying bearish sentiment.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.