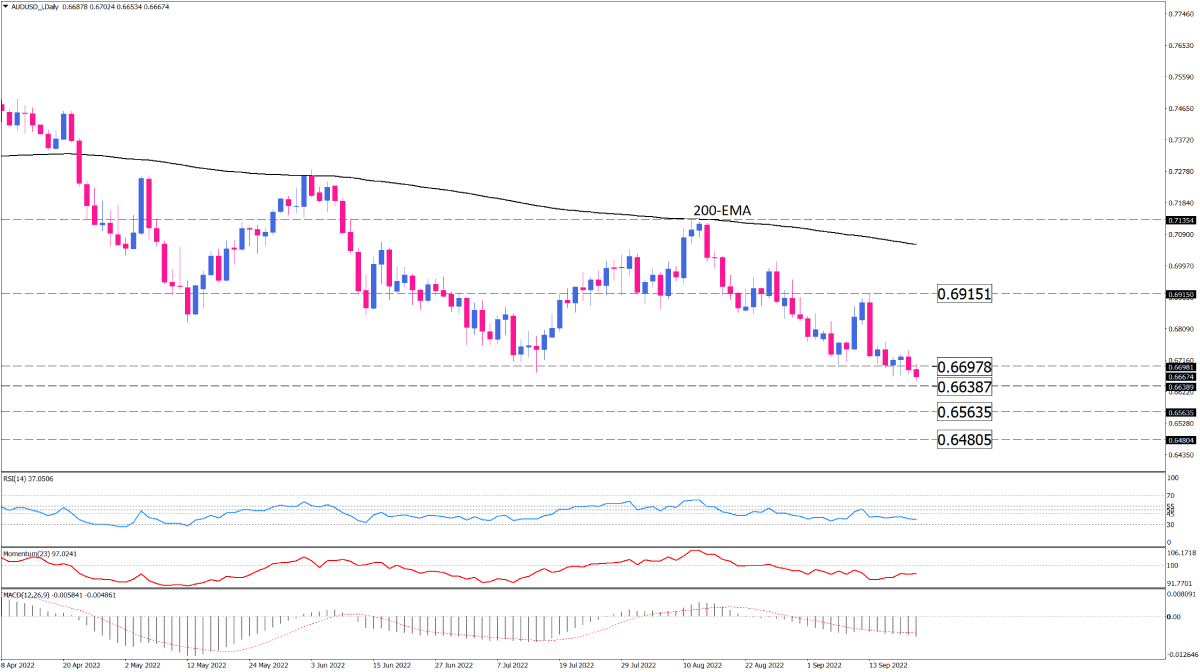

AUD/USD sellers keep up below a key support

AUD/USD has been trading in a bearish course since early April, and the 200-day exponential moving average has been serving as a reliable dynamic resistance. With the price retreating from this hurdle, the Ballinger bands have also turned in negative slope and the price is on a downward path within the lower half of the bands. The price reaction to the middle band indicates a dominant bearish bias in the short term.

Furthermore, AUD/USD sellers have managed to keep the price below the broken support of 0.66978 in continuation of yesterday's decline. The price is currently on the way to the next support level at 0.66387. If this level can't halt the further fall, sellers will target 0.65635 with more confidence. If the price breaks this barrier, the bearish trend can continue up to the 0.64805 level.

Otherwise, if buyers retake control at the lower Bollinger band, the pair may once again rise towards the 20-day moving average, the middle Bollinger band.

Short-term momentum oscillators imply a bearish bias. The dominance of sellers in the last three weeks has caused the RSI to enter the selling zone. Momentum is also moving in the selling area below the 100- threshold. The lengthening of the MACD bars in the negative area also shows the divergence of the short and long moving averages has increased, which confirms the accelerating bearish momentum.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.