Dow Jones pares gains as Powell warns about inflation

- Dow Jones gives away previous gains after Powell hints at a "higher for longer" stance.

- Hawkish Powell and geopolitical risks are offsetting Good quarterly earnings from United Health and Morgan Stanley.

- Technical picture remains bearish with DJIA drifting away from March highs.

The Dow Jones Industrial Average (DJIA) is practically flat on Tuesday's afternoon session as hawkish comments from the Federal Reserve (Fed) Chair, Jerome Powell have rattled equity markets. Speaking about the economy in a panel discussion in Washington, Powell observed a lack of progress on recent inflation figures, which endorses the view that the bank will be forced to keep interest rates at restrictive levels for a longer time.

These comments, coupled with the ongoing market concerns about the volatile situation in the Middle East, have offset the positive impact of quarterly earnings results by United Health and Morgan Stanley.

The main Wall Street indices have retreated after Powell's comments. the Dow Jones is 0.2% higher to 37,838, while the S&P 500 and the NASDAQ waver around opening levels at 5,062 and 15,900, respectively.

Dow Jones news

The Technology sector is leading gains with a 0.35% advance. That sector’s gains are followed by Health 0.25% higher. The Real Estate sector is the worst performer with a 1.08% decline, and next is the Energy sector, down 1.02%.

UnitedHealth (UNH) is outperforming with a 4.8% rally to $467.45 after its quarterly report beat expectations. Salesforce (CRM) rises 2.40% to $279.55. On the negative side, Apple (AAPL) loses 1.86% to $169.47. while Johnson & Johnson drops 1.7% to $145.06, and

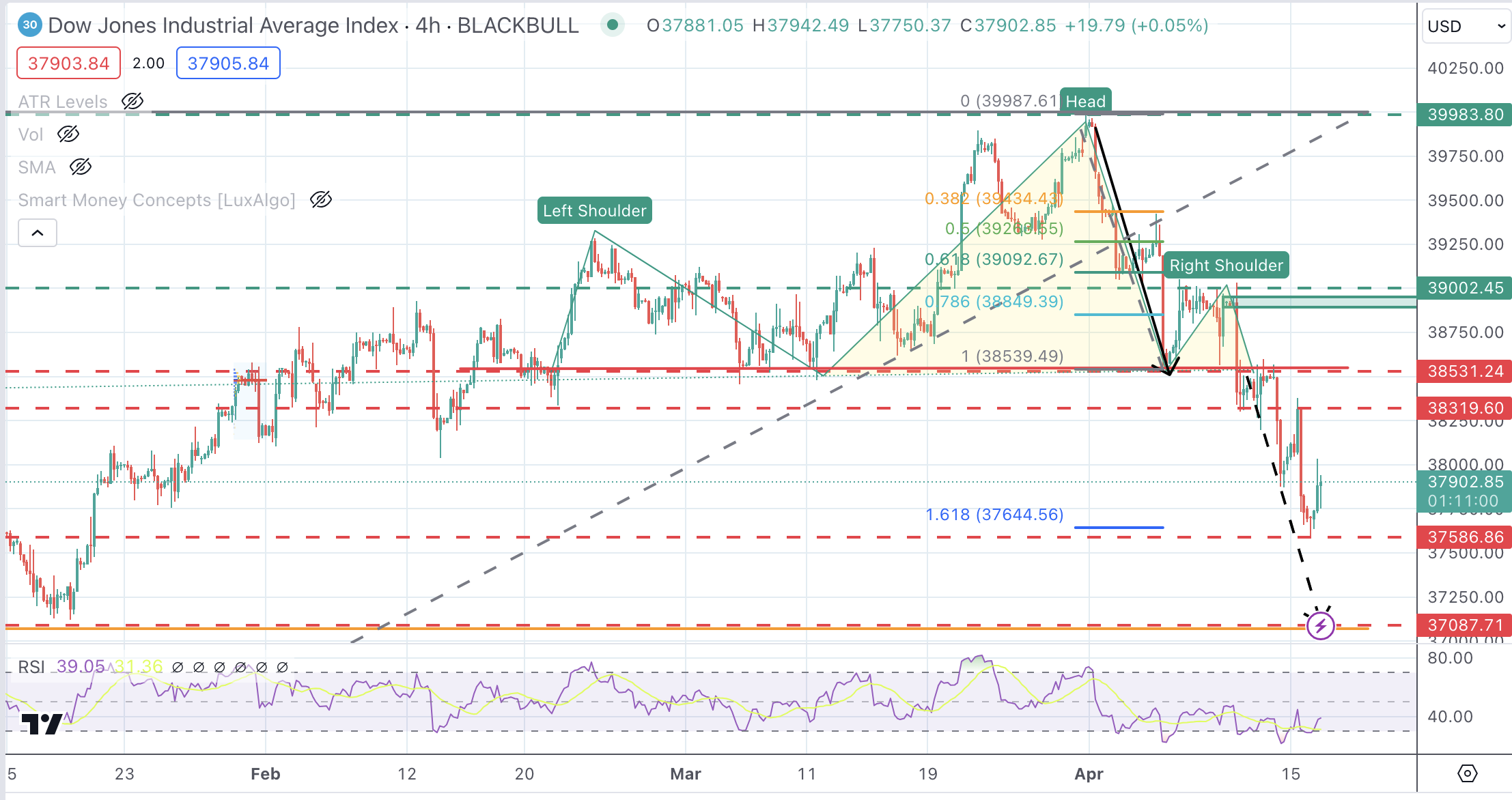

Dow Jones technical outlook

The DJIA index is trimming some loose ends on Tuesday although the overall picture remains bearish. The move below 38,560 has activated a Head & Shoulders pattern that points toward a sharper decline.

Immediate support is 37,586, followed by the measured target of the H&S pattern, which meets the mid-January low and 38.6% Fibonacci retracement at 37,087. A bullish reaction might find resistance at the 38,531 previous support ahead of the 39,000 region (order block).

Dow Jones Index 4-Hour Chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.