Canadian Dollar on the defensive in light Monday trading, Fed rate call looms ahead

- Canadian Dollar eases against broader market.

- Canada absent from economic calendar on Monday.

- Canadian GDP slated for Tuesday ahead of key US labor figures.

The Canadian Dollar (CAD) is broadly softer on Monday, slipping back against most of its major currency peers and holding flat against the US Dollar (USD) in tepid trading. The economic calendar is thin to kick off the trading week as the US Federal Reserve (Fed) and another US Nonfarm Payrolls (NFP) on Friday loom ahead later in the week.

Canada's latest monthly Gross Domestic Product (GDP) update is on Tuesday, but broader markets will be largely focused on the Fed’s upcoming rate call on Wednesday. US ADP Employment Change is also due Wednesday, and will serve as a preview (albeit a volatile one) to Friday’s US NFP jobs print.

Daily digest market movers: Thin data in US trading session leaves markets looking ahead

- Markets remain thin in the US market session, Canadian Dollar flattens against USD and Euro (EUR).

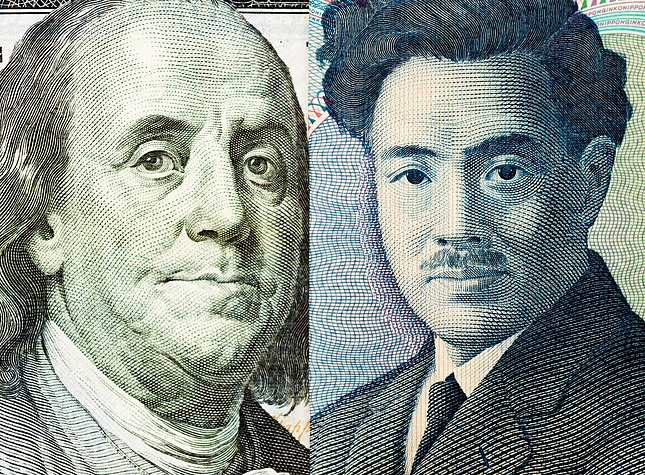

- Suspected intervention in global markets by the Bank of Japan (BoJ) on behalf of Japanese Yen (JPY) roiled Pacific markets, leaving a volatility vacuum in its wake.

- Tuesday’s Canadian MoM GDP is expected to decline to 0.3% in February after January’s 12-month high of 0.6%.

- Bank of Canada (BoC) Governor Tiff Macklem will be testifying alongside Senior Deputy Governor Carolyn Rogers before the Canadian government’s Standing Senate Committee on Banking, Commerce, and the Economy on Wednesday.

- BoC’s reporting is widely expected to get drowned out by markets focusing on Fed’s latest rate call, also scheduled on Wednesday.

- According to the CME’s FedWatch Tool, rate markets currently see around 58% odds of first rate cut in September.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.11% | -0.41% | 0.06% | -0.37% | -1.44% | -0.50% | -0.38% | |

| EUR | 0.11% | -0.30% | 0.17% | -0.25% | -1.31% | -0.39% | -0.27% | |

| GBP | 0.42% | 0.30% | 0.48% | 0.05% | -1.01% | -0.09% | 0.06% | |

| CAD | -0.06% | -0.18% | -0.48% | -0.43% | -1.49% | -0.57% | -0.46% | |

| AUD | 0.36% | 0.25% | -0.05% | 0.43% | -1.06% | -0.14% | -0.02% | |

| JPY | 1.42% | 1.29% | 0.99% | 1.47% | 1.03% | 0.93% | 1.03% | |

| NZD | 0.49% | 0.38% | 0.07% | 0.55% | 0.13% | -0.94% | 0.11% | |

| CHF | 0.38% | 0.27% | -0.04% | 0.44% | 0.01% | -1.05% | -0.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: Canadian Dollar flattens as markets look elsewhere

During Monday's US market session, the Canadian Dollar (CAD) treaded water, closing flat against the US Dollar and down a fifth of a percent against the Euro (EUR). The CAD also shed around half of a percent against the Antipodeans and in the red a full percent plus a third against the JPY.

USD/CAD continues to churn into the 1.3650 technical level. The pair continues to slip back from last week’s peak bids near 1.3850, but intraday bids still stick on the high side of a near-term supply zone between 1.3600 and 1.3550.

Despite a near-term pullback, the USD/CAD remains on the bullish side of long-term technicals. The pair still holds north of the 200-day Exponential Moving Average (EMA) at 1.3528, and the US Dollar is still up around 3% against the Canadian Dollar in 2024.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.