USD/CAD attempts to find direction ahead of CB meetings

Market participants will likely watch the USD/CAD very closely this week. This is because both central banks, the BOC and the Fed, will release their first policy decisions for 2022 on Wednesday, which can significantly impact the pair.

Central banks meetings in focus

The Fed is expected to take a more aggressive stance. In addition to anticipating hints of a March rate hike, some traders also believe the members will discuss unwinding the Fed's balance sheet in the near future.

On the other hand, the Bank of Canada is expected to increase the interest rate from 0.25% to 0.5%. The bank is also set to release its monetary policy report at the end of the meeting.

Generally speaking, a more hawkish than expected statement from the Fed has a bullish effect on USD/CAD, while a more aggressive stance from the BoC can strengthen the Canadian dollar, which is seen as a bearish sign for the pair.

Technical view

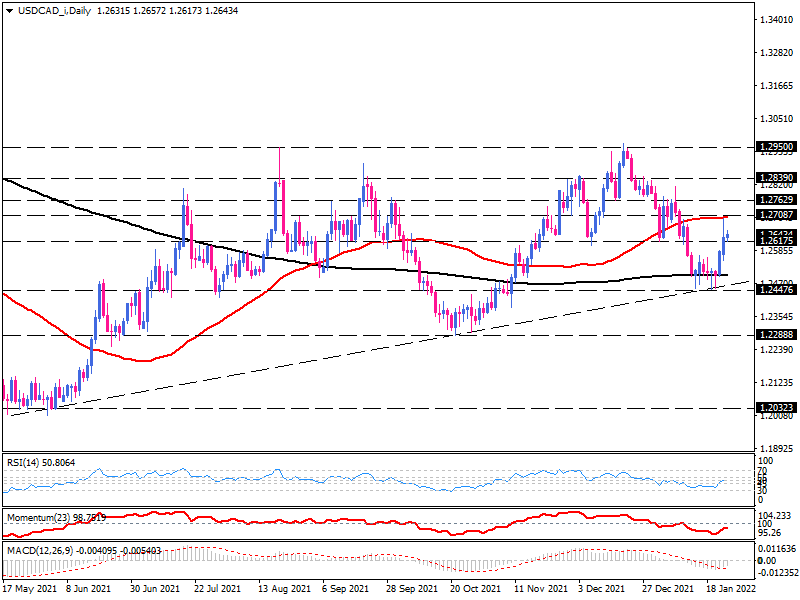

USD/CAD has been trading within an ascending triangle pattern since May 2021. After bouncing from the 200-Day simple moving average and the triangle support, bulls are attempting to hold above the 1.2617 support level and send the price towards the 50-Day SMA in line with the 1.2710 previous level of interest.

If positive momentum accelerates, buyers can overcome this hurdle and break through the 1.2763 resistance. As they become able to cross this barrier, they must clear 1.2839 first in order to reach the upper edge of the pattern at 1.2950.

On the flip side, if sellers take cues from 50-Day SMA resistance and retake control, the pair is likely to consolidate between moving averages for some time before taking a clear direction. However, a sustained move below 1.2447 would turn the sentiment to bearish, with sellers aiming for the 1.2288 handles around the October lows.

Momentum oscillators suggest that the bearish momentum is fading, but they have not yet confirmed the emerging bullish bias. The RSI is hovering in the neutral zone, while momentum is trending downward in the selling region. At the same time, the negative MACD bar is shrinking above its falling signal line.