The S&P 500 gains traction to a key resistance level

Before the Fed's policy meeting announcement on Wednesday, the S&P 500 futures index is attempting to rebound cautiously from its 7-month low. Markets appear to have already priced in the Fed's hawkish tone by falling over 9% from ATH.

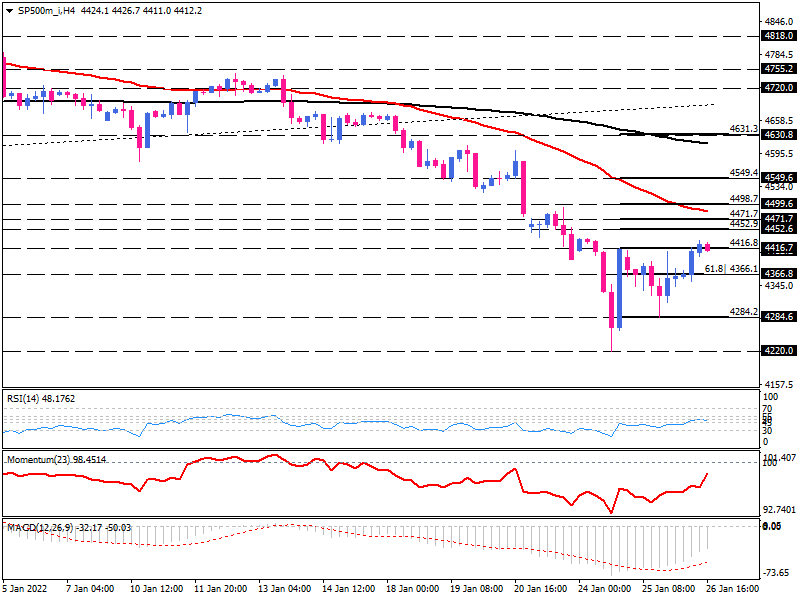

On the four-hour chart, following bottoming at 4220, the index made a higher bottom around 4284, indicating the downtrend is out of steam.

Currently, buyers are trying to gain traction and clear the resistance of 4416 around the previous top. They may establish a bullish run if they hold the ground above this level, which might inspire more buyers to enter the market.

If that happens, we can project the following obstacles on the Fibonacci tool, respectively 127% and 144% around the 4452 and 4471 levels. The 50-EMA lined up with a 161.8% Fibonacci level of 4499 can provide a potential target for buyers if they break out of this boundary.

Overcoming this crucial level would charge the rally to regain the 4549 mark.

Short-term momentum oscillators show the fading of selling forces. But so far, it seems the market is being more cautious than making a clear direction. The RSI pulled out of oversold territory into a neutral region. Momentum is reversing to the upside after dipping in the selling area. And the MACD bar is shrinking in the negative zone distancing above its signal line.

On the flip side, if 4416 holds resistance, the sellers may drag the price down to the 61.8% Fibbo support at the 4366 level. A further decline below this hurdle would lead to the previous bottom of 4284.