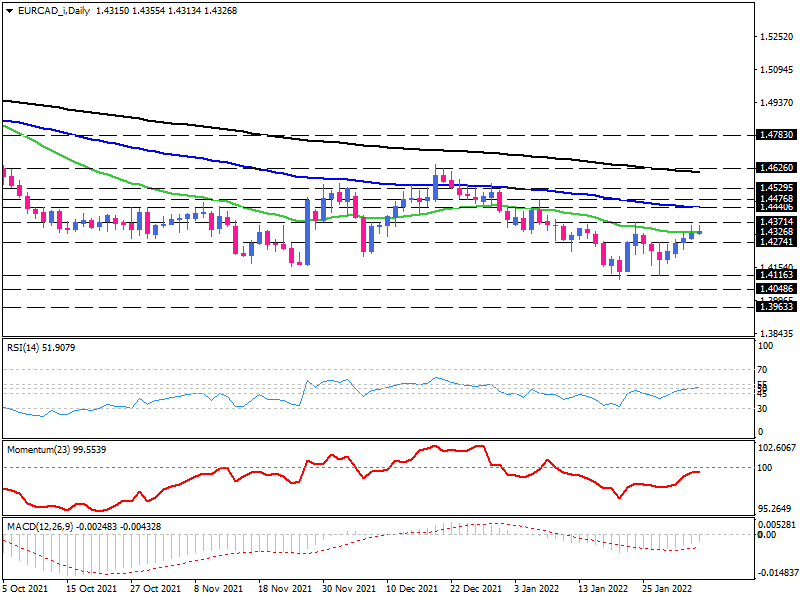

EUR/CAD heading a reversal at crucial resistance level

As we can see on the daily chart, the support area at 4-year lows between 1.4170 and 1.4116 has halted the prior downtrend and made some positive traction, and following the four consecutive positive days, the market is heading towards the 1.4371 mark. The formations of recent daily candlesticks imply plenty of resistance already loaded at this level.

Suppose buyers gather enough momentum to overcome this hurdle. In that case, we can interestingly see the completion of a double-bottom pattern which can be taken as a bullish reversal signal. Then, the initial resistance area would encounter at the boundary of 1.4440 and 1.4476, which lines up with the 50-day exponential moving average. By clearing this area, further positive traction can then send the pair to meet the 1.4529 resistance. Driving higher, the price would hit the 200-day EMA around 1.4626 at a three-month high.

Alternatively, if bullish pressure wanes, EURCAD might get down toward the 1.4116 previous level of interest. Should this crucial barricade break down, the price would resume the downtrend, falling towards 1.4048.

Short term momentum oscillators are indicating downward forces have slightly diminished. RSI has entered the neutral zone from selling territory, and momentum has pulled itself underneath the 100-baseline. At the same time, the negative MACD bars keep shrinking to zero in the distance above the signal line.