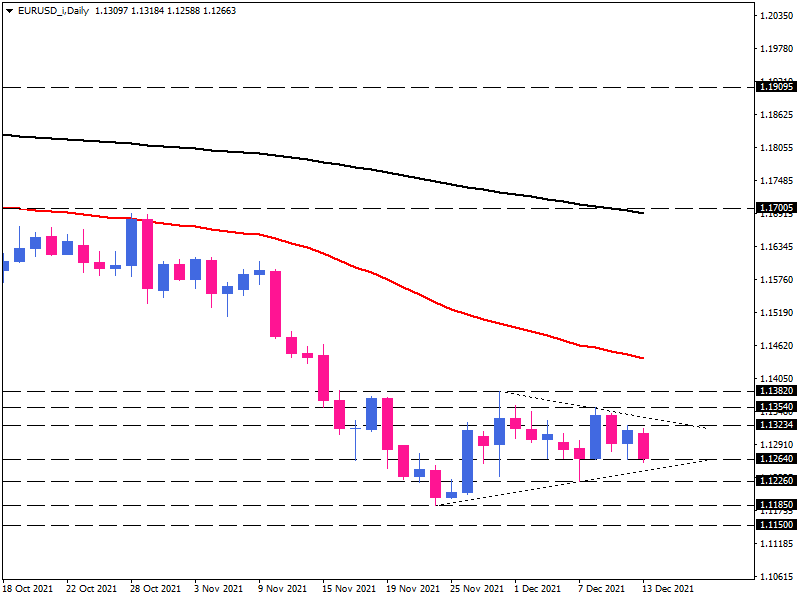

The EUR/USD is consolidating below 1.13

The single currency is bounded in consolidation on the daily chart, forming a pennant continuation pattern between the 1.1354 and 1.1226 marks. After peaking at the 1.1354-barrier, sellers are likely to keep prices down toward the lower line of the pattern. By the way, the market's next direction will depend on which side of the pennant pattern gets broken.

Technical outlook

The EURUSD has been developing a neutral bias over the last two weeks.

Based on the daily chart, it appears that the bears are trying to keep the pair below 1,13 at the moment.

With the single currency consolidating, the price has formed a pennant continuation pattern between the 1.1354 and 1.1226 marks.

Following the recent peak at the 1.1354-barrier, sellers are likely to keep prices down toward the lower line of the pattern.

By the way, the market's next direction will depend on which side of the pennant pattern gets broken.

On the downside, if the pair continues to decline, the pair could find immediate support from the lower line of the pattern. Should a sustained break below this area occur, the further decline will resume towards the 1.1185 and 1.1150 barriers.

Nevertheless, if the buyers gain sufficient momentum to force an upward breakout above the pennant, then the 1.1354 and 1.1382-barriers will be the following resistance levels to watch.

For the direction to shift to the 50-day EMA, the price would need to break decisively above the 1.1382 level.

The short-term oscillators indicate a mixed picture consistent with a neutral bias.

The RSI has returned to a selling zone, although the momentum is moving upwards below the 100-threshold. At the same time, the MACD is in negative territory, shrinking above its signal line.