GBP/USD bulls head to the one-week top

GBP/USD was limited in its gains ahead of the FOMC meeting by the underlying bullish tone prevailing around the US dollar.

In the morning European session, the pair gained strong positive momentum following the release of higher-than-expected UK consumer inflation figures. According to the headline CPI, prices increased 0.7% MoM in November and 5.1% YoY, and this was above expectations and the fastest increase since September 2008. Furthermore, core CPI also exceeded expectations and jumped 4% YoY, boosting the British pound marginally.

Later today, the Federal Reserve will announce its latest policy announcement, followed by a press conference by Chairman Powell. Market participants would interpret the Fed's decision to accelerate its bond-buying program and two rate hikes as an attempt to decrease rising inflation from its highest level in almost four decades. Two rate hikes will boost the dollar while higher inflation may soften the GDP growth forecast and result in a weaker USD.

Technical outlook in the short term

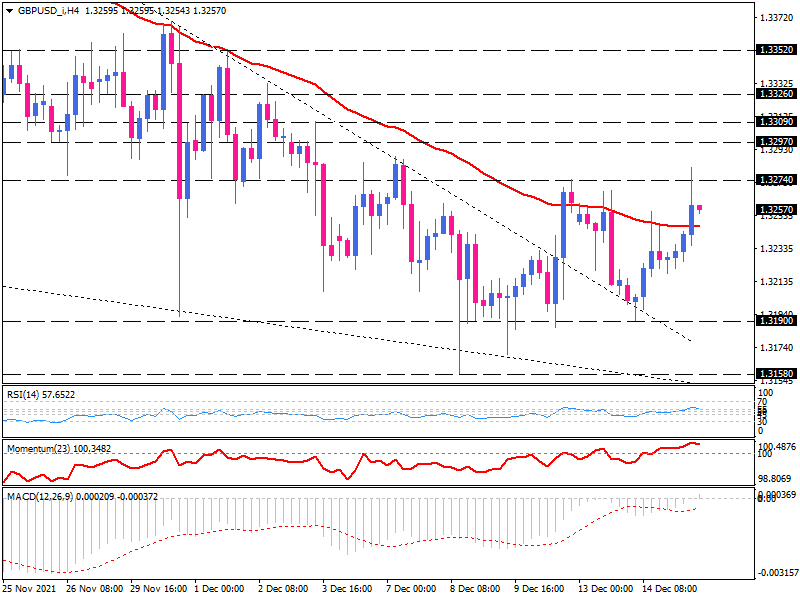

A four-hour chart provides a better picture of the short-term outlook. A successful pullback to the broken trend line support has prompted buyers to test the 50-EMA again.

The price needs to cross above the 50-EMA decisively in order to begin the move towards a firm resistance area around the 1.3274-level.

In the event that the bullish momentum peaks out, a break above this hurdle could draw in more buyers, aiming for the next resistances at 1.3297, 1.3309, and 1.3326 before ending up at the 1.3352 level of interest.

Alternatively, if buyers fail to get enough strength to overcome the previous high, the pound could be stuck inside the current range or even pushed back to Tuesday's low at 1.3190. Should the pound fall below this turning point, it would resume its downward trend toward its one-year low at 1.3158.

The oscillators support a bullish structure. RSI is pulling up against the neutral zone boundary, and momentum is in buying territory. In line with this, the MACD has exceeded the zero-threshold.