GBP/CHF forming a bullish reversal

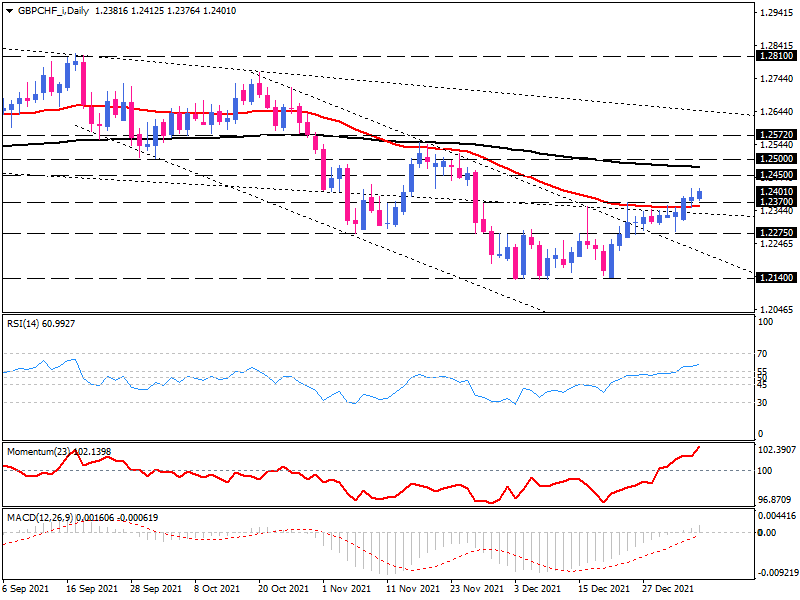

On the daily chart, after breaking above the falling channel, GBP/CHF buyers started the new year by passing the 1.2370 resistance area by forming a bullish double-bottom reversal pattern to keep the rally up for the fifth consecutive week.

The pair is still trading in a downtrend in the bigger picture as prices are below the 200-day exponential moving average. However, bearish momentum has been waning since bottoming at the one-year low of 1.2140.

We can evidence confluence at this level of 1.2370, as it not only does the neckline after penetration of the falling channel, but it’s right smack in line with the 50-day EMA. If more buyers take cues of this confluence, the pair may see higher prices around the 1.2450-barrier.

In the event that bulls take the pound up from this hurdle, the next obstacle will rise from a critical psychological level of 1.2500, coinciding with the 200-Day exponential moving average.

Persisting bullish momentum can then lead the price towards the 1.2572 mark.

Otherwise, should sellers manage to retake control and reverse the market below the 50-day EMA, the immediate support will come from the 1.2275 handle?

A breakthrough this level may result in further decline. But to resume the downtrend, sellers must push the pair below the December low of 1.2140.

Momentum oscillators are conveying bullish bias as RSI is moving up in buying territory, and the momentum is pointing north above the 100-base line. At the same time, the MACD bar is growing above zero-threshold.