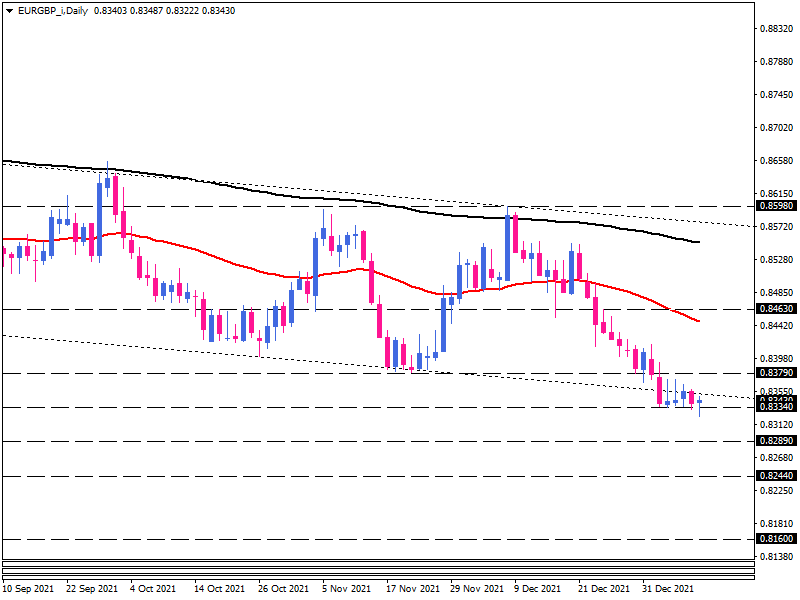

EUR/GBP bears battling one-week low

The EUR/GBP pair has recently broken the lower line of its falling channel. According to the current price action, the sellers are trying to keep prices down as they are attempting to break through the week-low of 0.8334. If the pair were to close below this benchmark hurdle, a two-year low would be attainable around the 0.8289-level.

We can expect to see the following support level rise from the 0.8244-mark in case the selling pressure continues.

A further decline in the market would encourage more sellers to step into the market, hoping to achieve the 0.8170 level of interest.

Short-term oscillators indicate that the EUR/GBP is moving in a bearish direction. Currently, the RSI is trending downwards in selling territory, and the momentum is pulling lower below the 100-threshold. The MACD is also dipping in the negative territory at the same time.

Alternatively, suppose that sellers were to be rejected in their attempt to break the current support at 0.8334. In that scenario, the pair might be setting its sights higher, and euro buyers could target the 0.8379-stretch to get back inside the channel. Consequently, this will allow the uptrend to gain traction on the pair and propel the price in the direction of the 0.8463-barrier, which coincides with the 50-day EMA.

However, it is implied that the pair's outlook will remain bearish as long as it is trading below the 50-day and 200-day exponential moving averages. Having said that, the bulls need to break above the December high of 0.8598 to turn the trend bullish.