EUR/AUD bears to extend slide below key supports

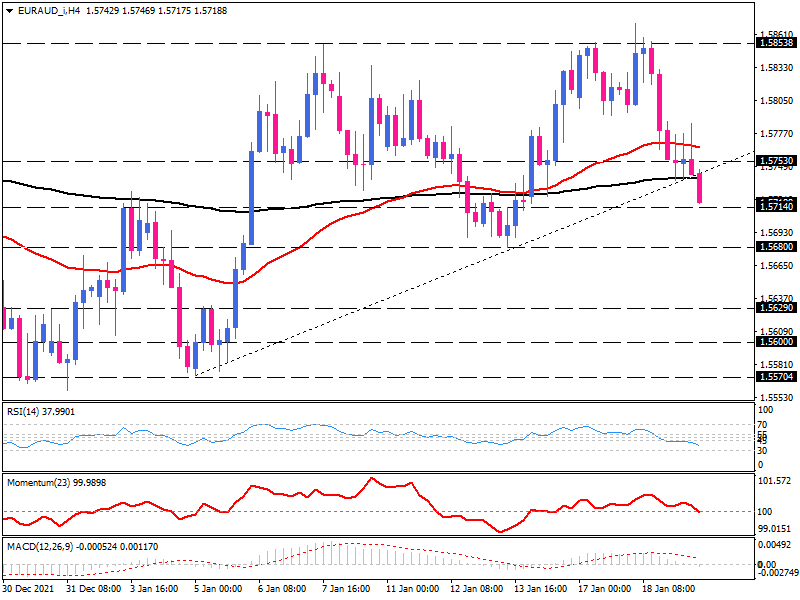

EUR/AUD is trading at a crucial turning point. Having failed to keep up above the 1.5853 significant resistance, the pair has fallen to the 200 exponential moving average, and sellers are now trying to push the price below this key support level, which is also in line with the short-term ascending trend line.

Since the downtrend continues, 1.57140 is estimated to be the immediate support. We shouldn't be surprised if the market re-tests the broken trendline.

After that, continued selling pressure could drive the price downwards to the record lows of January 13 around 1.56800. If sellers can overcome this hurdle, the next support level would be found at 1.56290. Should this handle fail to limit further decline, the price will fall to the December price floor between 1.56000 and 1.55704.

Otherwise, if buyers regain control of the market and the price rises above the 1.57530 mark, the 1.58538 handle will prove to be the next reliable resistance. Should this barrier be broken, the upward movement could continue.

The oscillators are flashing neutral and have not yet confirmed the dominance of sellers.

Important support levels:

1.57140.

1.56800.

1.56290.

1.56000.

0.65440.

Important resistance levels:

1.57530.

1.58538.

Momentum Oscillators:

RSI: Bearish.

Momentum: Neutral.

MACD: Netral.